The Best Budget and Personal Finance Apps For 2020 – 2021

It becomes a real ordeal when you get your salary one day, and in a span of one week, it simply vanishes away. You believe the root cause to be your spending habits, but the real reason is very trivial. Your spending habits do play a role here, but most importantly, tracking and management are the two major causes of it. If you learn how to track every single expense of yours, then you will know where to spend and where not to. Tracking and budgeting your cash and frequent expenses can even help you control your urge to shop without any purpose or need.

However, this notion is easier said than done. You can think of keeping a written journal of the time and days you have spent and how much you have spent, but that would still be ineffective. What you need is not a handwritten journal or a budgeting website. What you need is a personal finance and budgeting app. When you download one and begin to act according to it, you will know its sheer importance in your personal and financial life.

Here is a list of some of the best budgeting, expense tracking, and financial apps that every individual needs to download for both iOS and Android.

Wally Next

Available on both iOS and Android app stores, Wally Next is a free app that lets you keep in track of your budgets on the go. Previously called Wally, the app’s interface has now been changed, and the new look has made it even easier to use. Each feature to keep track of your expenses, finances, and budget is free, but it is not entirely free since it follows a freemium model for monetization. The only con of Wally Next is that it does not let you integrate your bank account to the app.

Money Lover

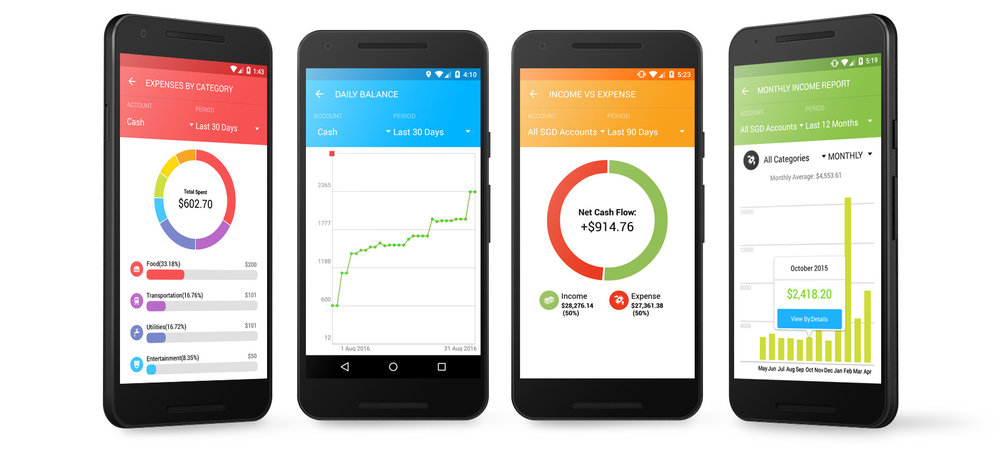

Another free iOS and Android app, Money Lover also supports a freemium model for each budgeting and financing feature it offers. You can keep track of your money and the cash you currently have in your bank account. According to your expenses and money, the app helps you create a befitting budget of your current, future, and prior spending.

PocketGuard

PocketGuard has all the options you need for budgeting and expenses. It also allows you to formulate a detailed list of how you can control your daily expenses. With time, the app will help you learn how much to spend every week, and your budget will be under your complete control. Once you connect your bank account to the app, all your information will be secure as PocketGuard has an in-built security encryption method that keeps all your bank account and card details secured and private at all times.

Wallet

Another budget-tracking app with immaculate features for iOS and Android, Wallet has intricate tools to help you track and manage your budget through a single app. After you begin setting up your app, you will notice that it will let you add multiple currencies at once or individually. If you intend to handle and adjust each transaction manually, then Wallet has all the needful options for you in place. You can track your budget, and make transactions with ease. The app itself is free but comes with a premium subscription plan if you want to unlock more features Wallet has to offer.

Tycoon

While the aforementioned apps were solely meant for budget tracking and financing, this particular iOS and Android supported app is a bit different from the rest. Tycoon lets the user track the jobs they have applied for which can even be freelance gigs. In fact, freelancers are Tycoon’s key target audience. Users can insert their active gigs and jobs and handle the expenses and earnings they make at once. Tycoon even comes with the option where a freelancer can calculate the tax rates and adjust expenses accordingly.

Dollarbird

An expense-tracking app for iOS and Android but with a twist, Dollarbird has an in-built calendar where users can track their expenses and budget by day and time. Every user will have a personal calendar where they can add and update their current or prior expenses. If you intend to plan your budget as well as the spending you make for the future, then Dollarbird has the option for that as well. Since scattering your expenses by day or month can be very taxing to view, Dollarbird can analyze each entry and find a befitting category for it.